how to set up a payment plan for california state taxes

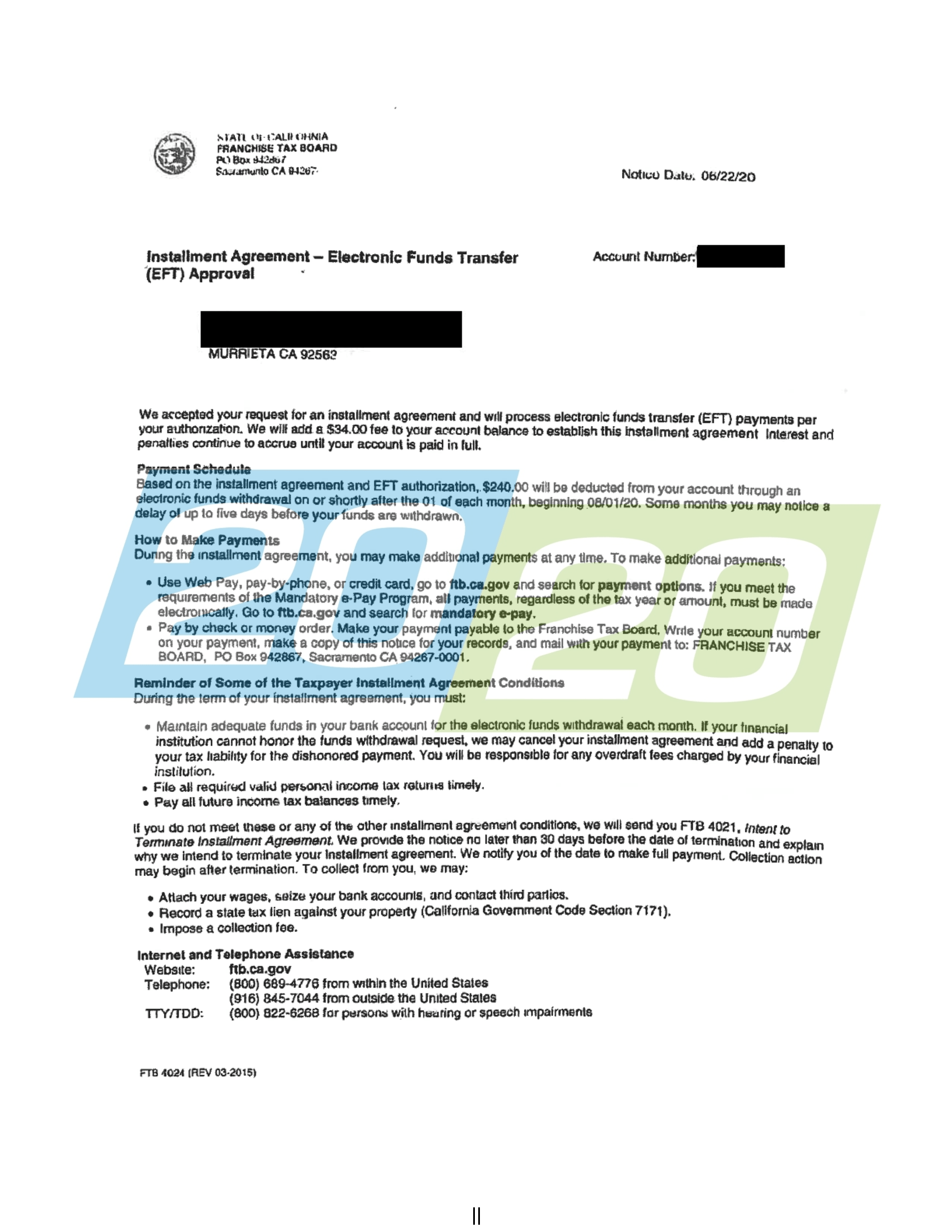

As an individual youll need to pay a 34 setup fee that is added to your balance when setting up a payment plan. To apply online go to My Tax Account and set up an account.

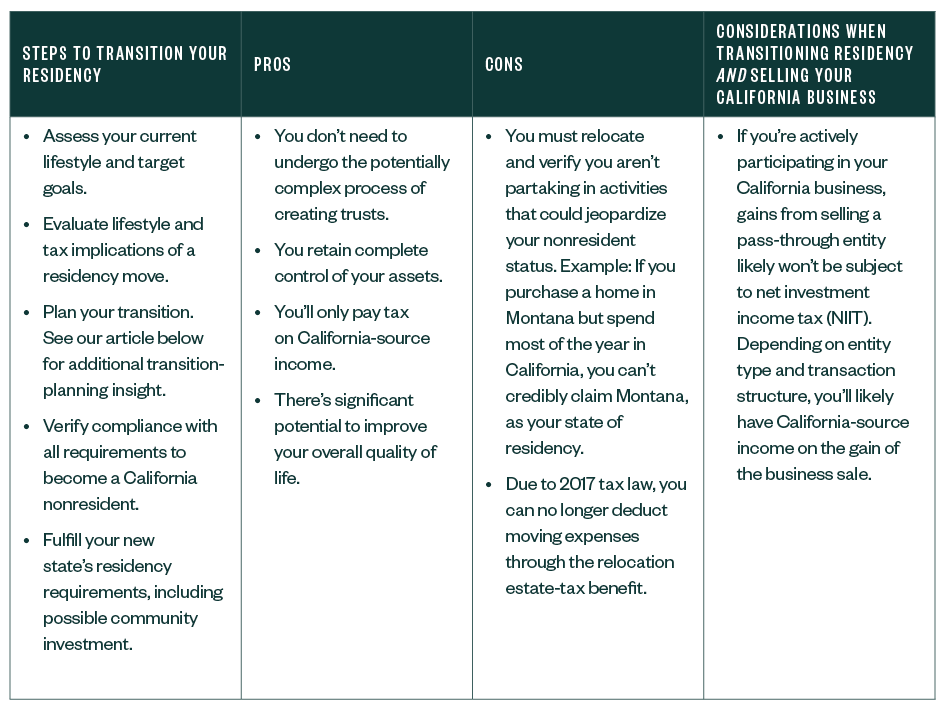

Considerations For Changing Your Residency From California

Some states require you to complete and submit a form.

. Sign in to the Community or Sign in to TurboTax and start working on your taxes. Why sign in to the Community. Offers in compromise OIC IRS Payment Plans for Individuals and Businesses.

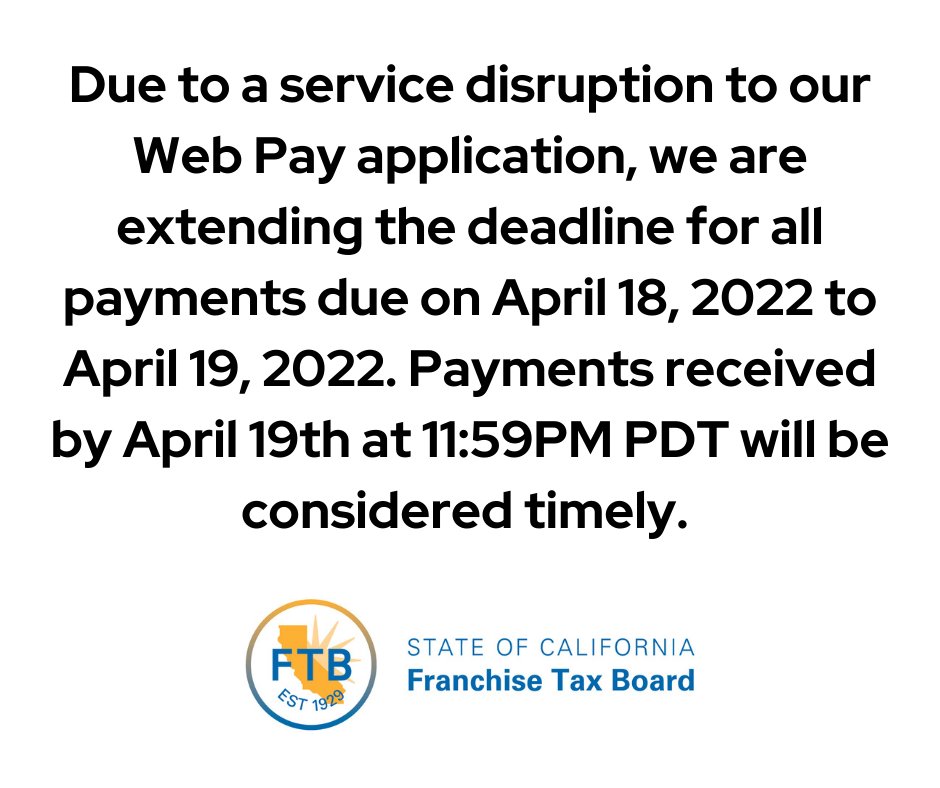

Follow your states procedure to make payment arrangements or set up a payment plan. How do i set up a payment plan for california state taxes owed. Then log in and select Manage My Collection Look at the options under Payment Plan and choose Request New Payment.

If you are ineligible for a payment plan through the Online Payment Agreement tool you may still be able to pay in installments. You may mail your completed application and payment to the address below. If you are looking to set up a payment plan that is less than 12 months in length and you owe less than 50000 you have a few options.

Once this is done you will make. The IRS offers several payment plans for taxpayers depending on the amount of. Call our Collections Department at 8043678045 during regular business hours to speak with a representative.

You can also review and manage your payment plan online. County of Los Angeles Treasurer and Tax Collector. For the state of Illinois you must.

How do i set up a. Yes California offers taxpayers the option to set up a California tax payment plan. You must meet certain basic admission requirements to be approved.

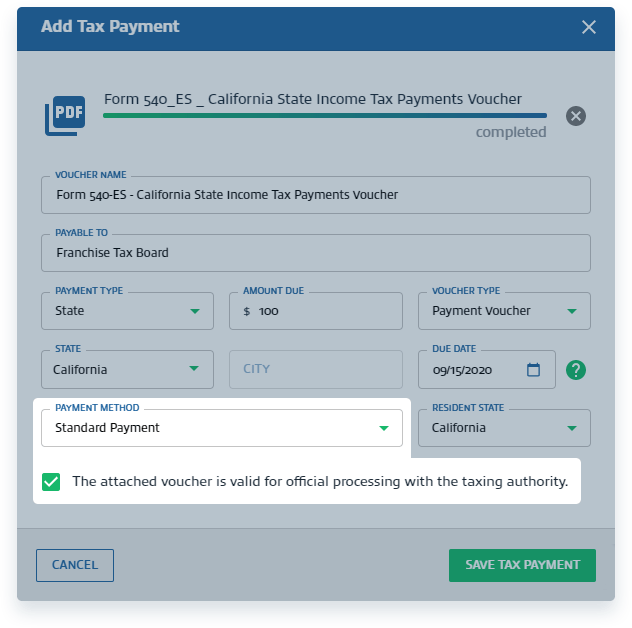

Individuals can complete Form 9465 Installment Agreement. Pay a 34 set-up fee that the FTB adds to the balance due Make monthly payments until the taxpayer pays the entire tax bill in full Pay by automatic withdrawal from a bank account Make. Businesses meanwhile are typically required to pay off whats owed within a 12.

Post Office Box 512102.

Gop S Faulconer Pitches Income Tax Cut Plan For California

Some Seniors And Disabled People Will Miss Out On New California State Payments Jefferson Public Radio

Surplus In Hand California Governor Proposes Tax Cuts Expanded Health Care Cbs8 Com

California Ftb And Irs Estimated Tax Payments Abbo Tax Cpa

State Of California Income Tax Rates Youtube

/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What S The Difference

State Accepts Payment Plan In Murrieta Ca 20 20 Tax Resolution

California Sending Out 705 000 Stimulus Payments Of 600 1 100 Next Week Orange County Register

When Is The California Llc Tax Due Date 2022 Guide

Covered California Income Limits Health For California

600 Payments For Low Income Californians Approved By Legislature

Payment Plans Student Services

California S Middle Class Tax Refund Payments Start Friday Abc10 Com

California Tax Breaks Extended To Undocumented Families

California Department Of Tax And Fee Administration Facebook